Digital asset manager CoinShares noted this development in its latest weekly report on the fund flow to Bitcoin and other crypto investment products.

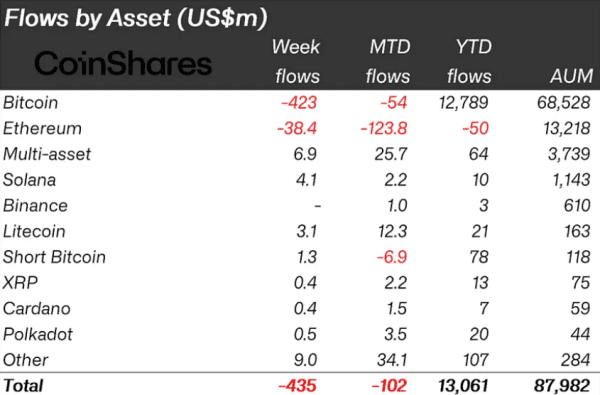

According to the report, last week’s $435 million outflow marked the largest since March this year. Alongside the negative flow, the volume of crypto exchange-traded products (ETPs) collapsed to $11.8 billion last week. This figure reflects a $6.2 billion deficit from the previous week’s $18 billion trading volume record.

Bitcoin Takes Biggest Hit

Notably, the outflows were more pronounced for Bitcoin than other crypto assets. In particular, the outflow from Bitcoin investment products alone was $432 million. On the other hand, Ethereum-based investments saw significantly lower negative flows at $38 million.

Meanwhile, a diverse array of altcoins witnessed inflows as investors opted for multi-coin investment products, resulting in $7 million in inflows. Also, favorite investments related to Solana (SOL), Litecoin (LTC), and Chainlink (LINK) maintained their appeal, attracting inflows of $4 million, $3 million, and $2.8 million, respectively.

Fund Flow Per Regions

Significantly, the majority of the outflows from crypto investment products last week were from the Bitcoin ETF market in the U.S. The U.S. spot ETF market saw a drain of $388 million, largely influenced by Grayscale Bitcoin Trust (GBTC). GBTC alone recorded a substantial $440 million outflow last week, but this was the lowest inflow in the last nine weeks.

While Grayscale’s negative flow trend gradually declines, other ETF issuers are witnessing a drop in inflow. For instance, last week saw an influx of $126 million to U.S. spot Bitcoin ETFs, down by 50% from the $254 million in the previous week.

Nonetheless, the U.S. Bitcoin spot ETF market has commanded an inflow of $13.6 billion since inception.

Regarding other regions, Germany and Canada similarly experienced bearish sentiment, with outflows of $16 million and $32 million, respectively, last week. However, Switzerland and Brazil defied this trend, seeing inflows of $5 million and $4 million, respectively.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.